News reports of a recent surge in prices has largely been restricted to consumer goods, although similar cost pressures are evident in the cleaning and hygiene supplies market.

News reports of a recent surge in prices has largely been restricted to consumer goods. Behind these price rises however has been the less reported increase in industrial raw material and product costs which have been evident across the world since the start of the year, with inflationary pressure at its highest since the financial crisis in 2008.

These inflationary pressures have also been building in the hygiene, cleaning chemicals and janitorial product markets, and we are now seeing price increases coming through from the manufacturers of these products. So, what are the specific cost increases at work in our sector?

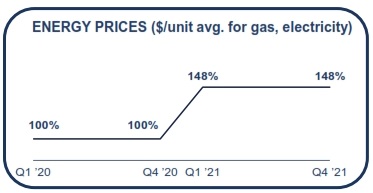

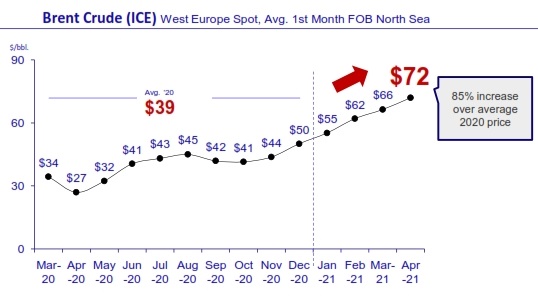

Energy and transport

Cost pressures common to all manufacturers in the sector include recent increases in energy and transport costs.

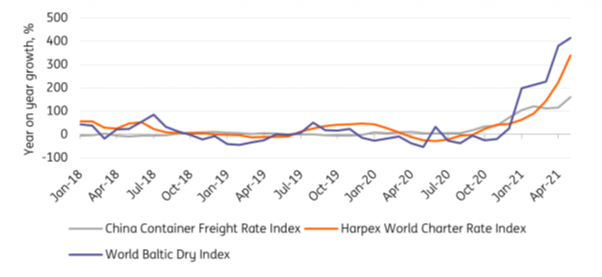

Escalating oil prices have been a strong driver behind transport costs, as well as high freight cost resulting from continuing capacity constraints in shipping, reported earlier in the year (see graph below also), and also shortages of HGV drivers.

Specific cost pressures also operate within individual factor markets.

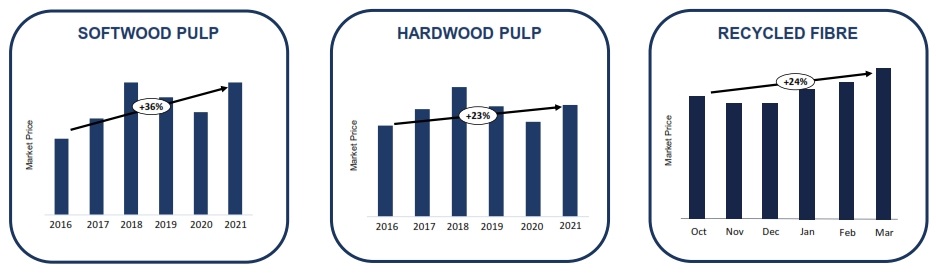

Pulp and recycled fibre

For the tissue and paper products manufacturers, there are long term raw material cost increases in pulp and recycled materials which have been intensified in recent months, consistent with global shortages in timber.

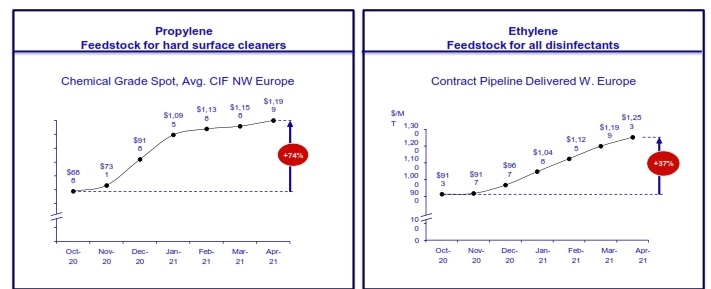

Propylene and ethylene

For the manufacturers of cleaning chemical manufacturers, the two key raw materials relate to propylene for a range of surface cleaners and ethylene for disinfectants. Both categories have seen significant recent increases:

Both the continued rise in shipping costs (below) and crude oil has driven up costs for janitorial hardware producers, typically those hardware products made from plastics and in the far east.

What does this mean for cleaning and hygiene product prices?

While the manufacturers have sought through efficiency measures to mitigate the impact on finished paper, chemical and hardware products, we are now experiencing across the board price increases ranging between 3% to 8%, depending on the particular product.

We ourselves are seeking to reduce the scope of these price increases on our customers through a number of means:

- using the significant bargaining position deriving from our membership of INPACS to cancel, limit, or defer increases

- seeking further efficiencies in our own operations

- where possible, and appropriate, helping customers to find product solutions which limit the cost impact on them

- in order to help with price stability, only operating six monthly price windows in January and July, with no increases outside of these months