As you will be aware, there has been a general and significant upsurge in prices across all sectors in the UK economy, and indeed globally in the last few months. Cleaning and hygiene supplies are no exception here.

In recent months we have seen manufacturers increase prices sharply and levy significant surcharges. For some producers, this has seen cumulative price increases of over 50% in the last twelve months.

In this article we summarise the main factors which have contributed to this inflation.

Energy Prices

The rapid escalation in energy prices - both gas and electricity - is the main contributor to the rising cost of cleaning and hygiene supplies.

There a number of macro economic factors which have led to sharp rise in the price of gas:

- generally increased demand as national economies recovered from the impact of COVID shutdowns, particularly from Asia

- a reduction in Europe's natural gas reserves (c.20%) due to a reduction in supply by major natural gas suppliers over the last winter

The chart below shows the escalation in gas prices over the last twelve months, which are some five (5) times higher at the start of April 2022 than they were in the same period in April 2021, and have consistently been at this trend level since August 2021 . In December 2021 and March 2022 these prices peaked at ten (10) times and eleven (11) times respectively.

Table 1: Natural gas price index (source: www.bbc.co.uk/news/topics/cxwdwz5d8gxt/natural-gas)

|

Electricity prices have also seen significant increases, with the wholesale price experiencing increases up to three (3) times over the last year. The main factors here include: the lower production of renewable energy during the year, high gas prices (leading to energy substitution) and the increased cost of EU European Emission Trade System (ETS) certificates from EUR 5/ton to EUR 60/ton.

Finally, the already adverse trend in energy prices has accelerated as a direct result of the conflict in Ukraine. Natural Gas prices

peaked in early March with market volatility showing no signs of abating. The likelihood of further sanctions imposed by the West on

Russian oil and gas supplies are likely to have additional severe impacts on energy pricing.

Raw Materials

For paper products manufacturers the availability and price of recycled fibres (also known as Sorted Office Waste or SOW) and virgin pulp, along with energy, is also a key driver of product cost.

Key factors driving these raw material costs include:

- post COVID economic recovery, especially in Asia and China specifically, has led to shortages particularly in recovered waste paper, as well as many other raw materials

- the availability SOW is in short supply as the UK office sector occupancy rates are still well below pre-pandemic levels, leading to less paper usage, and less waste paper generated.

Since January 2021, the respective prices of SOW and virgin pulp have both increased by over 40%. The following charts demonstrate the longer term trends.

Table 2: Movements in the price of SOW and Pulp (graphs courtesy of Northwood):

|

|

For manufacturers of cleaning chemicals, the two key raw materials driving production costs relate to propylene for a range of surface cleaners and ethylene for disinfectants. Both categories have seen similar recent significant increases.

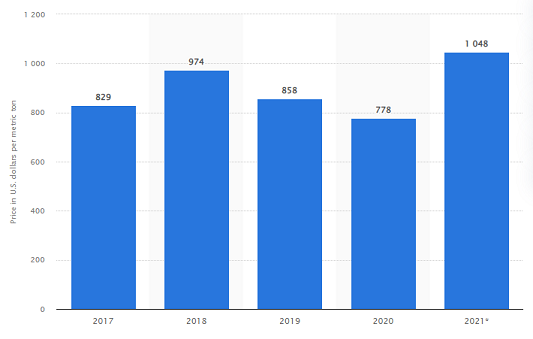

Table 3: Medium term Propylene Prices (source: Statista.com)

|

The rising cost of plastic waste sacks and a wide range of janitorial items (mops, buckets, janitorial equipment made from plastic) can be directly linked to movements in the crude oil price (see Table 4 below).

Table 4: Crude Oil Price Movements (source: Factset Research Systems)

|

Transport Costs

Transport costs in general have risen sharply as a result of both the escalation in HGV drivers salaries as well as the rise in fuel costs. The TEG Road Transport Price Index shows that since the start of 2021, haulier costs have increased by a trend rate of 20%. The continuing shortage of HGV drivers is widely documented, and we are all well aware of the recent sharp increase in petrol pump fuel costs driven by increases in crude oil costs (see Table 4).

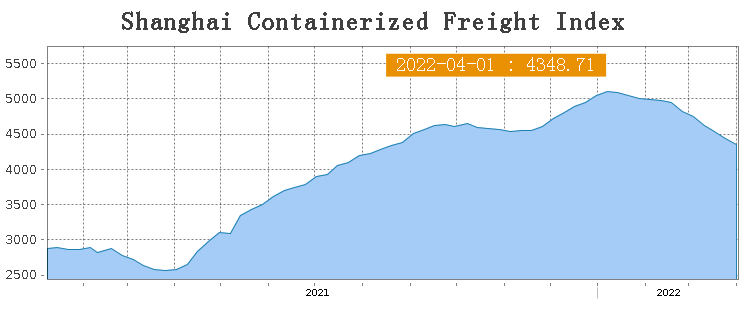

Many janitorial and PPE goods are imported and the pricing of these products is heavily influenced by freight shipping rates. These reached peak levels during 2021 as port closures, containers located in the "wrong" parts of the world, and an overall physical shortage of containers contributed to shipping rates reaching unprecedented levels. Although the market is now softening , rates nevertheless remain at historically high levels.

|

Other factors

There are a range of other subsidiary factors which have contributed to the general increase in the cost of cleaning and hygiene supplies. These include most notably the increase in the wage cost of manufacturing and logistics staff within the industry, who must compete with the rates offered by the larger online sellers and courier services operating from large distribution centres.

Finally, the rapid increase in energy prices has caused some paper mils to suspend operations and even shut them down completely, with a reduction in the supply of base sheet tissue. This has led lead convertors to scramble for available supply with the inevitable pressure on finished tissue goods prices.

Outlook

The outlook remains very uncertain and likelihood of further price increases in cleaning and hygiene products across the board is high. Much will depend on how the Ukraine conflict plays out and the consequences for European energy prices.

We ourselves are seeking to reduce the scope of these price increases on our customers through a number of means:

- using the significant bargaining position deriving from our membership of INPACS to cancel, limit, or defer increases

- seeking further efficiencies in our own operations

- where possible, and appropriate, helping customers to find alternative product solutions which limit the cost impact on them